Utility Tax

Refund Experts

for qualifying NY State Entities

80% of reviewed utility bills get refunds

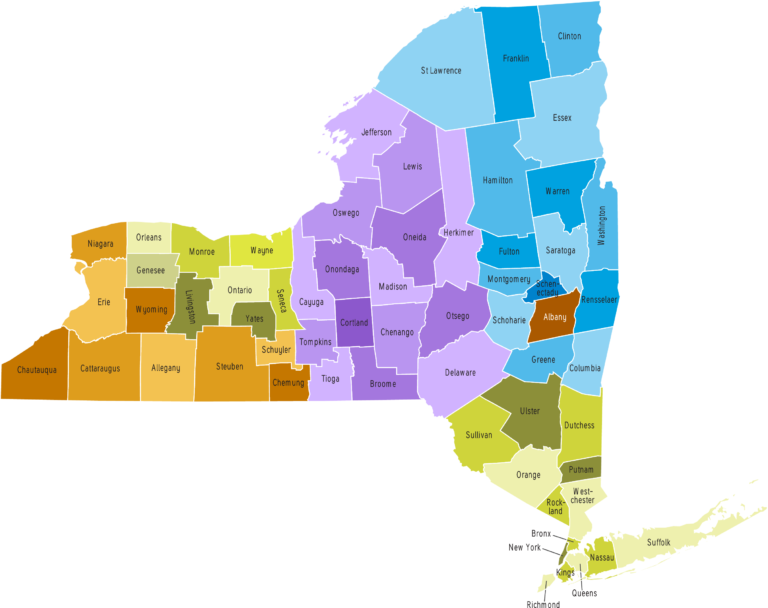

Who is eligible?

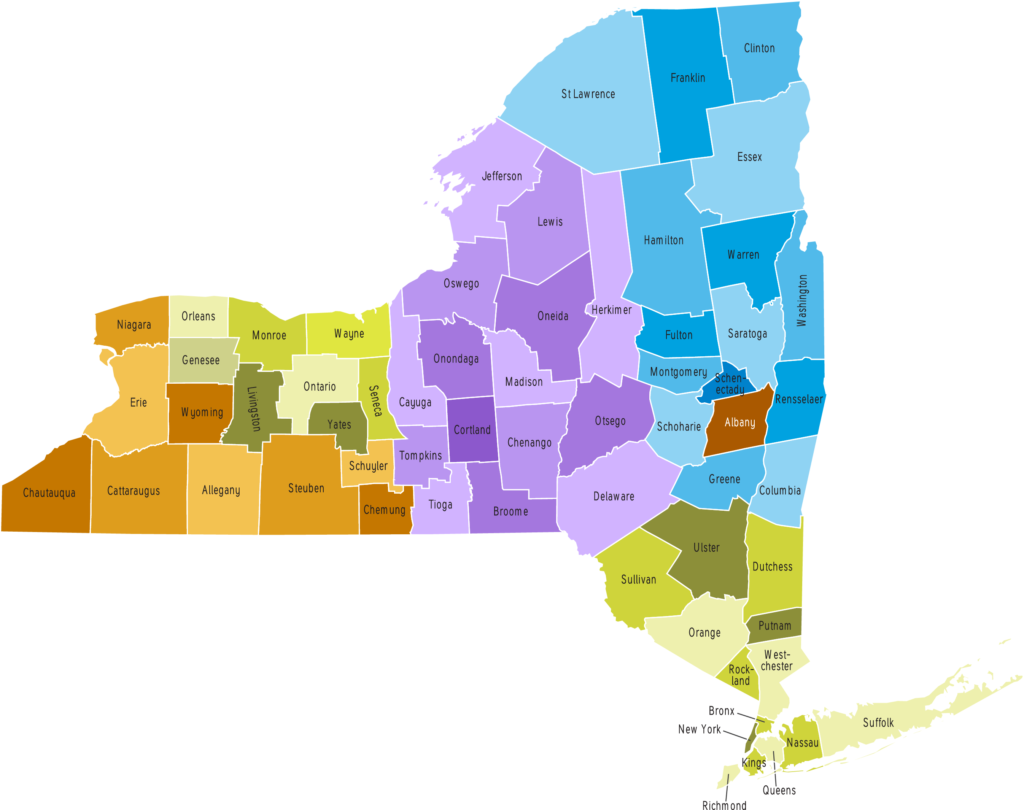

In New York State?

Utilities have complex tax codes.

And when you are exempt or partially exempt,

there’s no reason not to get that refund.

That’s where we come in.

Experience

Knowledge

All it takes is 5 minutes of your time

Give us a call

Send us your

paperwork

(3-6 months later)

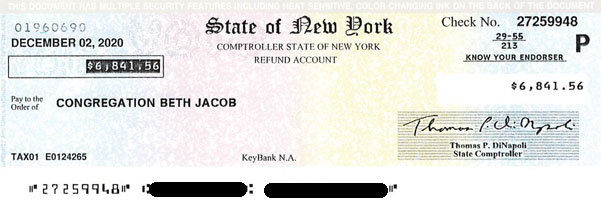

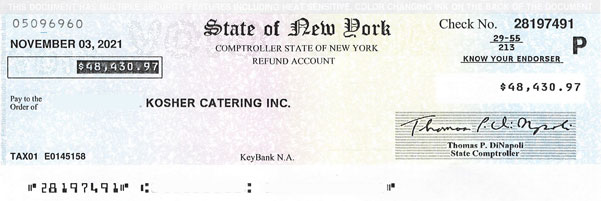

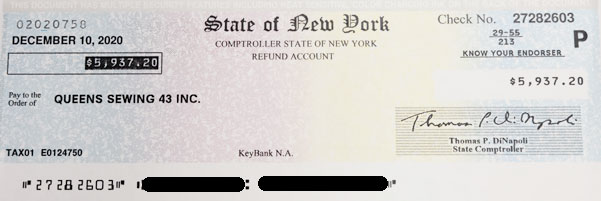

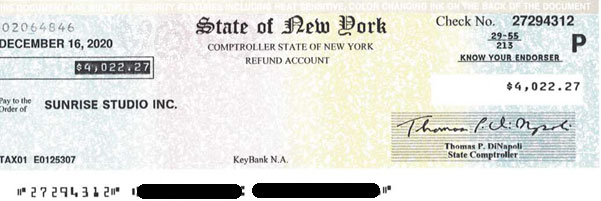

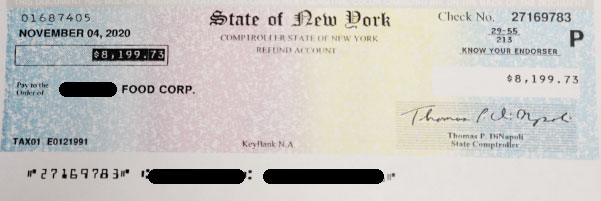

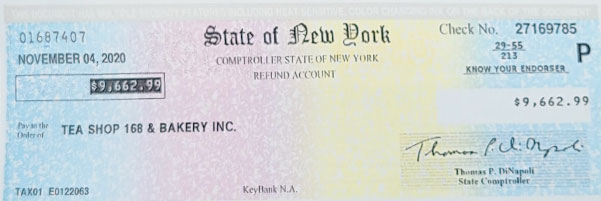

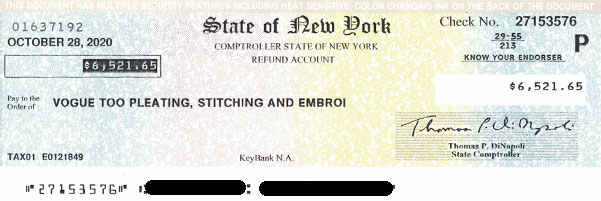

Deposit your

hand-delivered

check

It’s as simple as that.

5 star google reviews

Harvey Kaufmann

Wonderful experience on refund; easiest refund that I have ever done!

Kaufman Bros Printing

Kevin Chow

Super Satisfied with my refund.

- BF Apparel INC

Sol Yudkowsky

Dina is the best!

She was super helpful 🙂

Abe has a very professionally run operation and dealing with Power 7 is always a pleasure!

Eun Kyong Chung

During this COVID time, I want to say how thankful I am to Edmund and this company. They gave us an electric refund and was...Read More »

jaclyn damico

Super happy with a $3k check on a Friday delivered to me!! Recovered all my sales tax from past 3 years from New York State!...Read More »

Why you never heard About this?

Utility taxes are not an accountant’s expertise, it’s a specific area of expertise which we have learned and mastered and most business owners are not knowledgeable enough in the codes and requirements and would not know how much you are overpaying by looking at a utility bill.

We just get you cash back (well, ok, a check) on your utility taxes.

Reach out today and get back

money that’s rightfully yours.

Reach out today and get back money that’s rightfully yours.

The maximum time to claim your refund is 36 months.

- 100% risk free

- only pay when you get a refund